First test drive of a 2012 3.7 mustang.......my 2 cents

#21

I'm deliriously happy with my 2012 V6 manual, great car, light years ahead of my old beater '04 V6. And it is a 2.73 car and so far I really like watching the mpg readout as it climbs more than it falls. Had it up to 36.8 mpg for a short time on the way home from the dealer.

I just today got my insurance done on it and mine is about $500 for 6 months, barely higher than the '04 beater. Of course I didn't go crazy and get 5 million in liability...

I just today got my insurance done on it and mine is about $500 for 6 months, barely higher than the '04 beater. Of course I didn't go crazy and get 5 million in liability...

#22

If you don't mind me asking, what is "good coverage"? I have 5 million in liability, $500 collision deductible, $200 comprehensive deductible, and few other options that don't add a ton of cost to the insurance. The car is a 2012 V6 that's insured for around $30,000. The cheapest I will ever get to, with a car worth this much, is $2000/Year after 10 years driving experience. Right now I have 5 years and it cost me $3000/Year. No tickets or accidents.

I'm just curious to see what other people pay in different areas.

I'm just curious to see what other people pay in different areas.

#23

X2. With my almost 200 mile a day commute, I had to have the MPG over top spped. My 2011 V6 Mustang with it's 3:31 rear is fantastic, and I'm seeing 24.4 to 24.7 MPG cruising at 80 on the highway.

#24

The law may be different where you live, but I really don't want to be paying off a mistake for the rest of my life. My insurance is up in about 2 months so I'll look into changing the liability, but I won't be going lower then 1 million for sure. To me $500K seem very low but I guess it's all about what kinda risk you're willing to take and how much people can get away with suing you for.

#25

It's not what you own, they can sue you for what is found reasonable. If you don't have the money or belongings they can with hold money off your paychecks until you pay it off. After I wrote that last post I thought more about my policy and I remembered that I had talked about 5M but decided to stay at the 3M I previously had.

The law may be different where you live, but I really don't want to be paying off a mistake for the rest of my life. My insurance is up in about 2 months so I'll look into changing the liability, but I won't be going lower then 1 million for sure. To me $500K seem very low but I guess it's all about what kinda risk you're willing to take and how much people can get away with suing you for.

The law may be different where you live, but I really don't want to be paying off a mistake for the rest of my life. My insurance is up in about 2 months so I'll look into changing the liability, but I won't be going lower then 1 million for sure. To me $500K seem very low but I guess it's all about what kinda risk you're willing to take and how much people can get away with suing you for.

#26

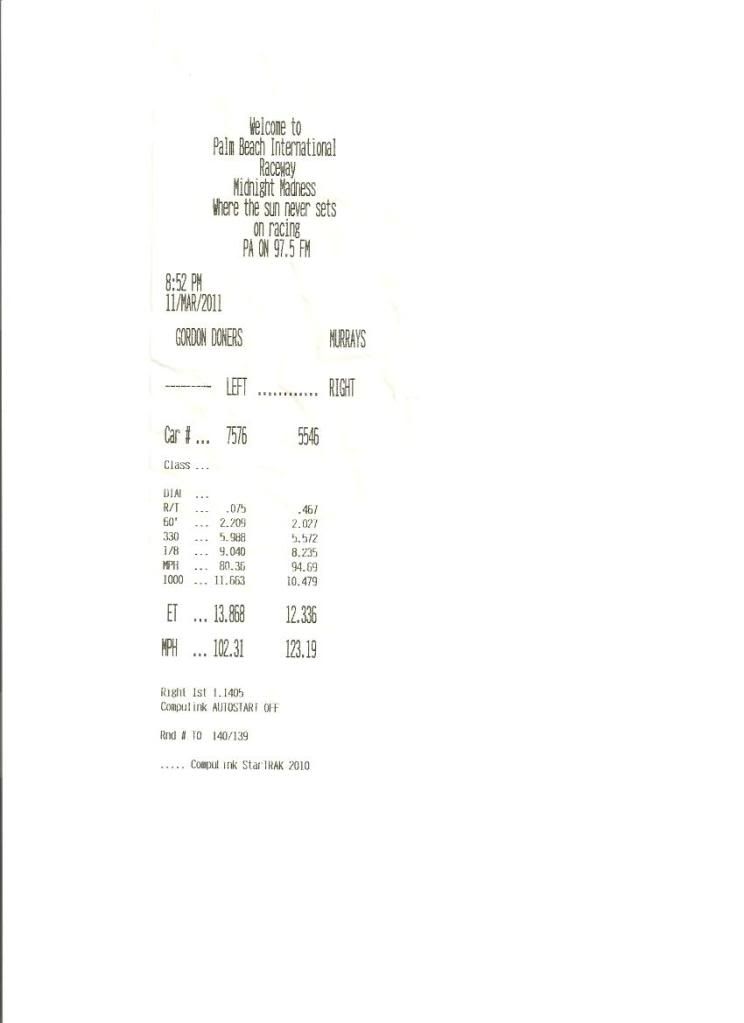

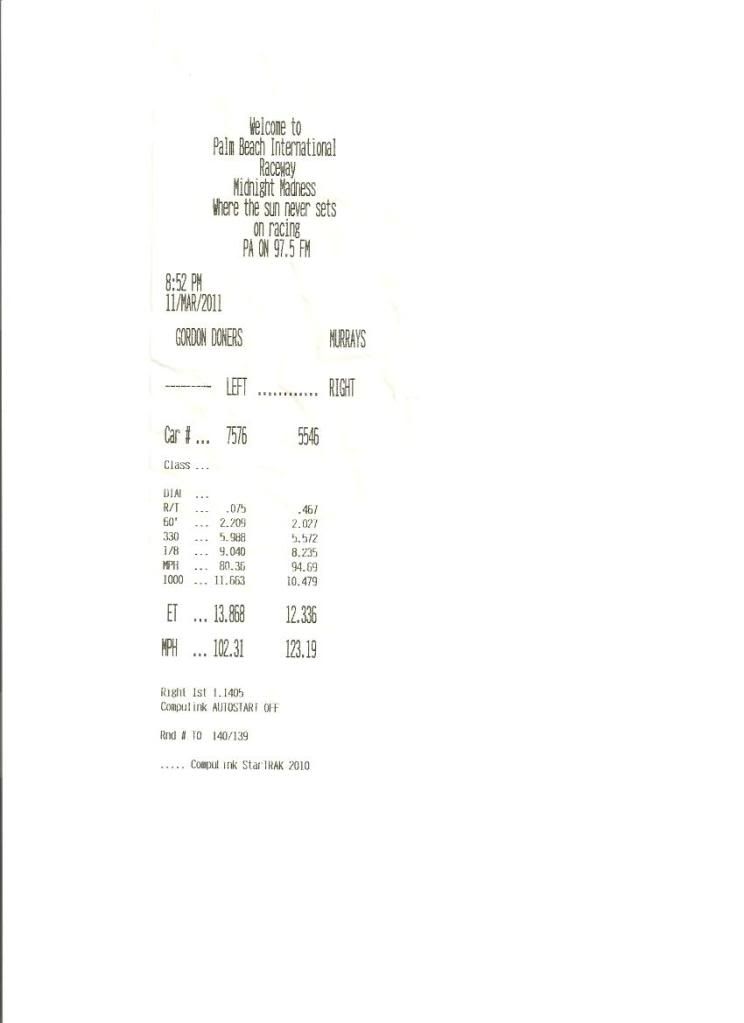

I took my wife's 2011 V6 auto with the 3.31 rear axle to the track once. That little 3.7 is quick! I got to make only two passes the whole night. On the first pass I launched by power-braking to bring up the RPMs some and it just spun the stock tires really bad. The second launch was WOT from an idle and it ran a 13.8 @ 102, which was very respectable and better than some of the V8s that night. Below is the timeslip. I'm sure I could've done even better with more practice.

#27

Either way back to the topic.

Sorry for the thread jack, I didn't think it would take this many posts.

#28

If you don't mind me asking, what is "good coverage"? I have 5 million in liability, $500 collision deductible, $200 comprehensive deductible, and few other options that don't add a ton of cost to the insurance. The car is a 2012 V6 that's insured for around $30,000. The cheapest I will ever get to, with a car worth this much, is $2000/Year after 10 years driving experience. Right now I have 5 years and it cost me $3000/Year. No tickets or accidents.

I'm just curious to see what other people pay in different areas.

I'm just curious to see what other people pay in different areas.

It's not what you own, they can sue you for what is found reasonable. If you don't have the money or belongings they can with hold money off your paychecks until you pay it off. After I wrote that last post I thought more about my policy and I remembered that I had talked about 5M but decided to stay at the 3M I previously had.

The law may be different where you live, but I really don't want to be paying off a mistake for the rest of my life. My insurance is up in about 2 months so I'll look into changing the liability, but I won't be going lower then 1 million for sure. To me $500K seem very low but I guess it's all about what kinda risk you're willing to take and how much people can get away with suing you for.

The law may be different where you live, but I really don't want to be paying off a mistake for the rest of my life. My insurance is up in about 2 months so I'll look into changing the liability, but I won't be going lower then 1 million for sure. To me $500K seem very low but I guess it's all about what kinda risk you're willing to take and how much people can get away with suing you for.

Well - you asked (about insurance coverage), so I threw in my 2 cents.

On the surface (your implied age), it seems your agent is taking advantage of you. Auto insurance claims are not the same as child support (wherein portions of paychecks are garnisheed). I've had to learn insurance law over the years, and no court is going to waste time delving into the minutia of a traffic accident when the resources are not there. In most cases, claims are settled rapidly between insurance companies. Coverage is the first step. If the damage – bodily, property or otherwise - exceeds the coverage, then a suit can be filed to go after your assets – meaning your home (or the portion you actually own as equity), vehicles, investments, etc. That’s a worst-case. If you don't have enough assets to settle such a claim, no insurance company is going to want to waste their resources taking the matter before a backed-up court system to potentially sue you for future wages. Exceptions may be if you are a well-paid professional (e.g., doctor) – or with a business…but then, you’d have separate insurance for your business of course.

$30/$50K bodily injury liability is minimal (person/occurrence) – but usually is accepted as the minimum. Something like $50/$100K or $300/$500K is quite a bit. It's a bit like comparing apples to oranges due to age and other factors - but I pay roughly $800/yr for a $35K Mustang, with $300/500K and a $100 deductible for collision. But I'm quite a bit older than you, with multiple vehicles on a 20+yr policy. If you’re concerned about your assets (how much is the net worth?), get an umbrella policy – but those aren’t cheap.

Not meant to be an argument re insurance coverage - just some advice about auto coverage. No sense in throwing your money away. Not to insurance companies!

#29

Well - you asked (about insurance coverage), so I threw in my 2 cents.

On the surface (your implied age), it seems your agent is taking advantage of you. Auto insurance claims are not the same as child support (wherein portions of paychecks are garnisheed). I've had to learn insurance law over the years, and no court is going to waste time delving into the minutia of a traffic accident when the resources are not there. In most cases, claims are settled rapidly between insurance companies. Coverage is the first step. If the damage – bodily, property or otherwise - exceeds the coverage, then a suit can be filed to go after your assets – meaning your home (or the portion you actually own as equity), vehicles, investments, etc. That’s a worst-case. If you don't have enough assets to settle such a claim, no insurance company is going to want to waste their resources taking the matter before a backed-up court system to potentially sue you for future wages. Exceptions may be if you are a well-paid professional (e.g., doctor) – or with a business…but then, you’d have separate insurance for your business of course.

$30/$50K bodily injury liability is minimal (person/occurrence) – but usually is accepted as the minimum. Something like $50/$100K or $300/$500K is quite a bit. It's a bit like comparing apples to oranges due to age and other factors - but I pay roughly $800/yr for a $35K Mustang, with $300/500K and a $100 deductible for collision. But I'm quite a bit older than you, with multiple vehicles on a 20+yr policy. If you’re concerned about your assets (how much is the net worth?), get an umbrella policy – but those aren’t cheap.

Not meant to be an argument re insurance coverage - just some advice about auto coverage. No sense in throwing your money away. Not to insurance companies!

On the surface (your implied age), it seems your agent is taking advantage of you. Auto insurance claims are not the same as child support (wherein portions of paychecks are garnisheed). I've had to learn insurance law over the years, and no court is going to waste time delving into the minutia of a traffic accident when the resources are not there. In most cases, claims are settled rapidly between insurance companies. Coverage is the first step. If the damage – bodily, property or otherwise - exceeds the coverage, then a suit can be filed to go after your assets – meaning your home (or the portion you actually own as equity), vehicles, investments, etc. That’s a worst-case. If you don't have enough assets to settle such a claim, no insurance company is going to want to waste their resources taking the matter before a backed-up court system to potentially sue you for future wages. Exceptions may be if you are a well-paid professional (e.g., doctor) – or with a business…but then, you’d have separate insurance for your business of course.

$30/$50K bodily injury liability is minimal (person/occurrence) – but usually is accepted as the minimum. Something like $50/$100K or $300/$500K is quite a bit. It's a bit like comparing apples to oranges due to age and other factors - but I pay roughly $800/yr for a $35K Mustang, with $300/500K and a $100 deductible for collision. But I'm quite a bit older than you, with multiple vehicles on a 20+yr policy. If you’re concerned about your assets (how much is the net worth?), get an umbrella policy – but those aren’t cheap.

Not meant to be an argument re insurance coverage - just some advice about auto coverage. No sense in throwing your money away. Not to insurance companies!

Thanks for the help, if I have more questions I'll start a new thread.

#30

Thanks Lava Dude, it's good to hear that info. You're right there is no sense in throwing your money away. Before I renew my insurance I'm gonna look more into laws and how the court system works with this type of thing. I didn't take my advice from my insurance agent, I talked to friends, family and co-workers. I'm just turning 22 so I know I'm young and this car has all my money right now so it's great to save where I can.

Thanks for the help, if I have more questions I'll start a new thread.

Thanks for the help, if I have more questions I'll start a new thread.

#31

Ditto this. I absolutely love my state.

Thread

Thread Starter

Forum

Replies

Last Post

Evil_Capri

Ford Discussions

1

8/27/15 01:08 PM

tj@steeda

2015 - 2023 MUSTANG

0

7/30/15 06:47 AM

roushcollection

Auto Shows and Events

0

7/28/15 02:08 PM